BRIEFLY

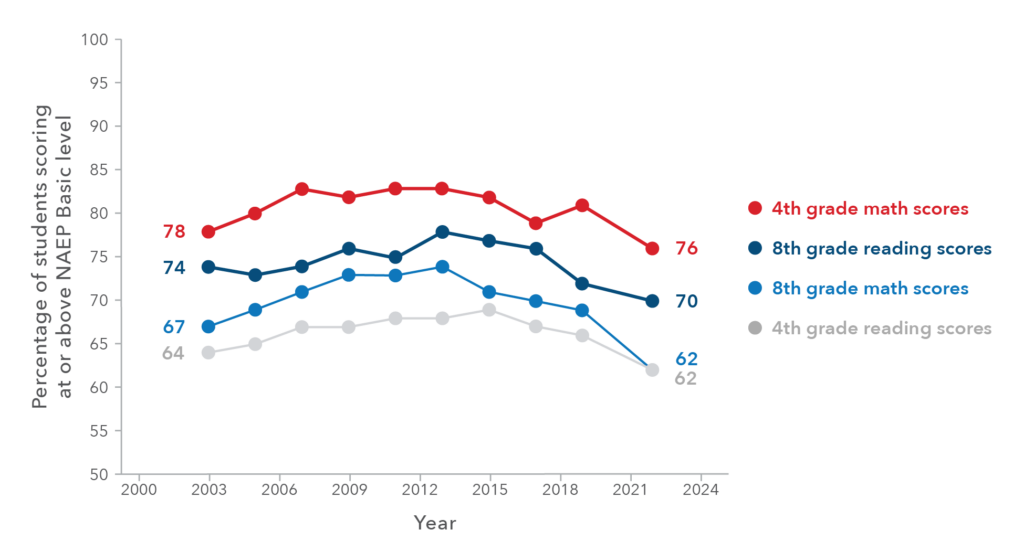

The COVID-19 pandemic created not only a public health emergency but a youth education crisis as well. Decades of progress in math and reading among America’s students were wiped away in two years. The federal government passed three rounds of funding to help school districts mitigate the disruptions of the pandemic, but that aid is set to run out next year even as little progress has been made in returning student achievement to pre-pandemic levels. This In Brief examines the scope of student learning loss, what the federal government and districts have done thus far to help students, and what the federal government can do now to put America’s students on a better path forward.

WHAT TO KNOW

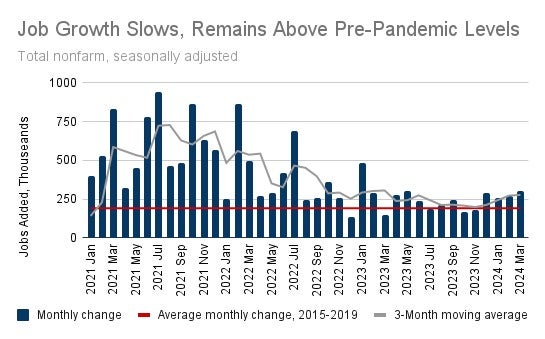

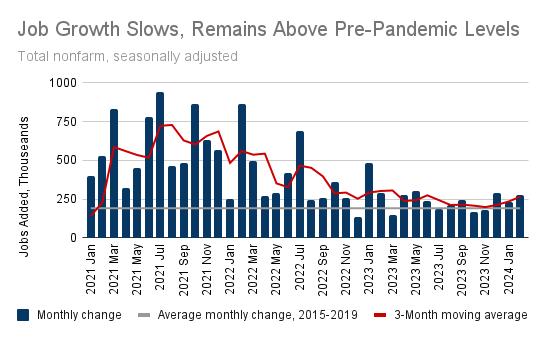

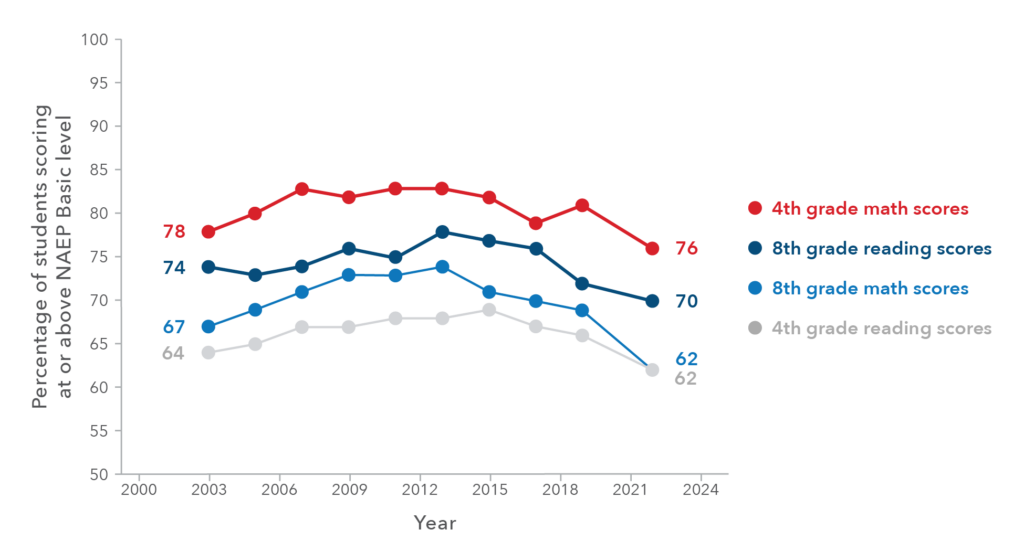

- Pandemic-induced learning loss has reversed two decades of progress in student achievement. Figure 1 charts student test score performance over time from the National Assessment of Educational Progress (NAEP), also called “TheNation’s Report Card.” The portion of students at or above “Basic” achievement levels in math and reading has fallen sharply since 2019 and is now below 2003 levels. Compared to 2019 results, the percentage of fourth graders at or above NAEP Basic levels in math and reading fell by 5 and 4 percentage points, respectively. The biggest decline is in eighth-grade math scores, where the share of students scoring at or above Basic levels declined from 69 percent in 2019 to 62 percent in 2022.

Figure 1: Percentage of students scoring at or above NAEP Basic level, by grade and subject, 2003–2022

Source: National Assessment of Educational Progress (NAEP).

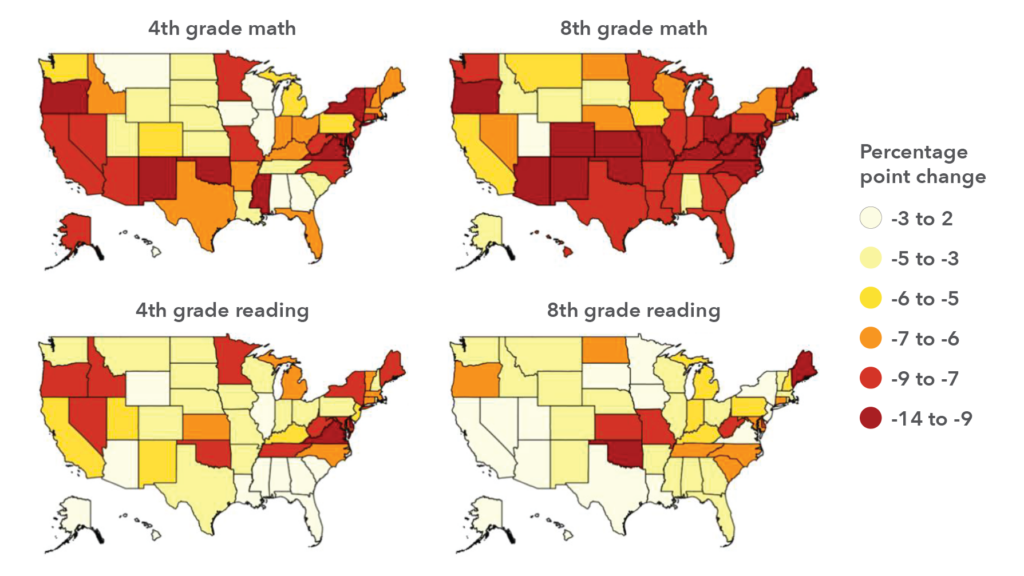

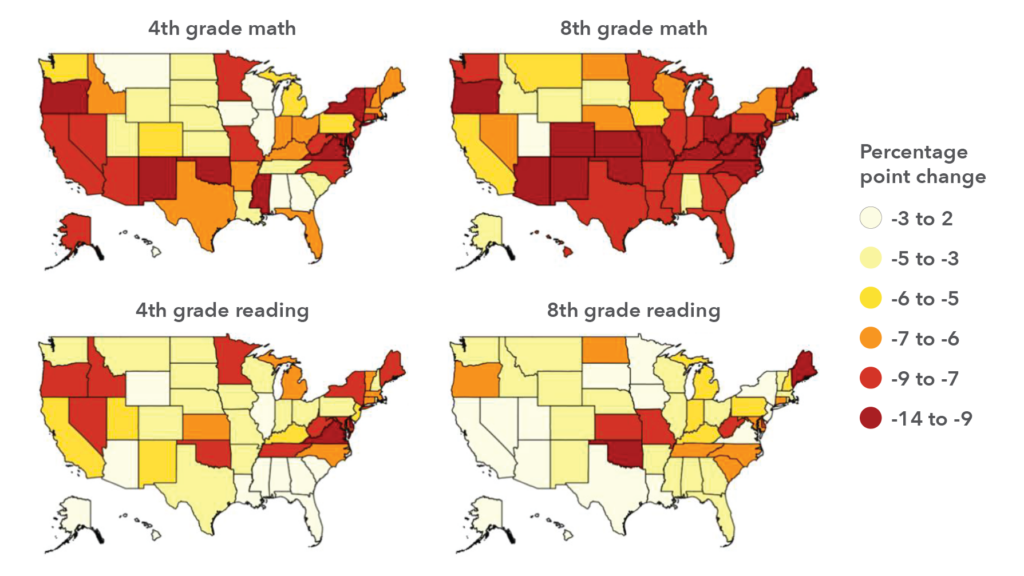

- The declines in student achievement were not uniform across the country. Figure 2 plots the changes in students performing at or above NAEP Basic levels by state. For instance, in eighth-grade math, 19 states experienced a decline greater than the 7 percentage point national drop (with declines as large as 14 percentage points), and 20 states saw smaller drops (with the smallest declines at 2 percentage points and no states seeing gains). Research finds that states that maintained access to in-person schooling during the pandemic saw smaller declines in math and reading progress, a relationship explored in more detail below.

Figure 2: Change in share of students scoring at or above NAEP Basic level, by grade and subject, 2019–2022

Source: National Assessment of Educational Progress (NAEP).

- Shifts to virtual learning and a concomitant rise in chronic absenteeism have driven declines in student achievement. The shift from in-person to remote or hybrid instruction during the pandemic had profoundly negative consequences for student achievement. Hallaron et al. (2021) estimates that the decline in test scores from 2019 to 2021 was on average 10 percentage points larger in districts that did not maintain in-person instruction as compared to those that did, after adjusting for differences in district-level test-score trends and demographic differences across school districts. The shift to remote schooling also exacerbated educational inequality. An analysis of test scores from 2.1 million US students in 10,000 schools finds that Black and Hispanic students’ performance dropped significantly more than that of white students with similar baseline scores and school poverty levels—primarily because Black and Hispanic students were more likely to live in districts that shifted to remote schooling.

- As districts around the country resumed in-person instruction, many students did not return to school. The number of public school students who are chronically absent—meaning they miss at least 10 percent of days in a school year—has nearly doubled, from about 15 percent in the 2018–2019 school year to around 30 percent in 2021–2022. The White House Council of Economic Advisors estimates that, based on the pre-pandemic association between absenteeism and test scores, the rise in absenteeism can account for a portion—though not all or most—of the post-pandemic decline in test scores: 16–27 percent of the drop in math scores and 36–45 percent of the decline in reading.

- If declines in student learning are left unmitigated, millions of students—and the country—will be worse off in the future. While the decline in test scores itself is alarming, this problem will only compound itself over time. Research finds that school test scores are strongly predictive of later-life outcomes, even after controlling for differences in student characteristics and family backgrounds. Students who can’t read at grade level by third grade, for example, are four times less likely to graduate high school. Using the historical relationship between academic achievement, earnings, and economic growth, researchers estimate that pandemic-induced learning loss could reduce lifetime earnings by $49,000 to $61,000 per student. That reduction will cost the US approximately $128 billion to $188 billion each year as this cohort enters the labor force.

- In 2020 and 2021, the federal government allocated $189.5 billion in temporary funding to school districts to address pandemic-related disruptions. Most of these funds are allocated to school districts through the Elementary and Secondary School Emergency Relief (ESSER) Fund, which was built up in three phases: initially in the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act; the 2021 Coronavirus Response and Relief Supplemental Appropriations Act; and in the American Rescue Plan (ARP) later in 2021. The law stipulates that districts are generally free to spend these funds as they choose— on teacher salaries or building upgrades, for instance—but they are required to be spent by September 2024, and at least 20 percent of funds allocated in the ARP phase must be allocated to overcoming pandemic-related learning loss. Although the roughly $190 billion effort appears to be a significant increase over the $757 billion spent on public schooling in the 2019–2020 school year, Jonathan Guryan and Jens Ludwig estimate in their recent AESG chapter that, after taking into account that these funds are intended to be spread out over four years, this support accounts for about a 6 percent increase in annual funding—and part of these funds are intended to offset drops in school district revenue during the pandemic.

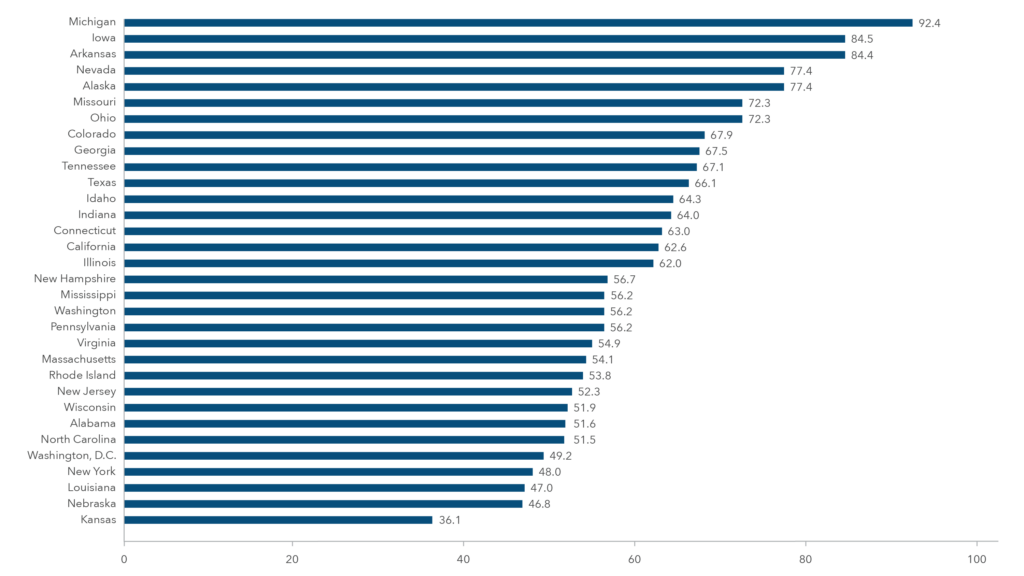

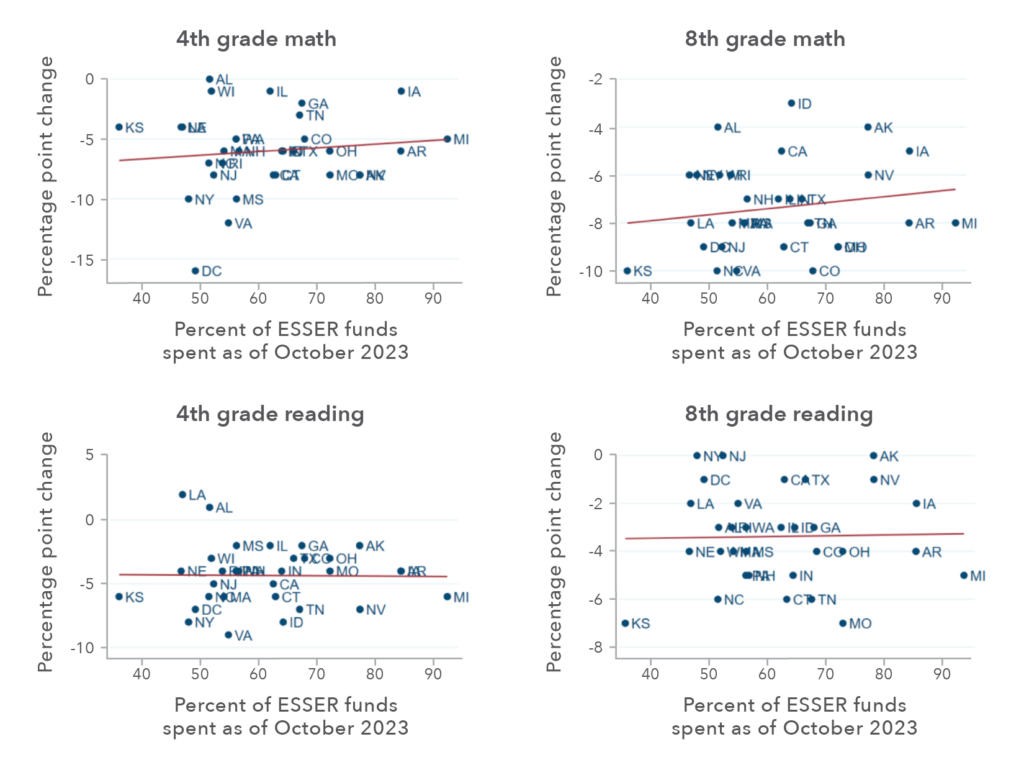

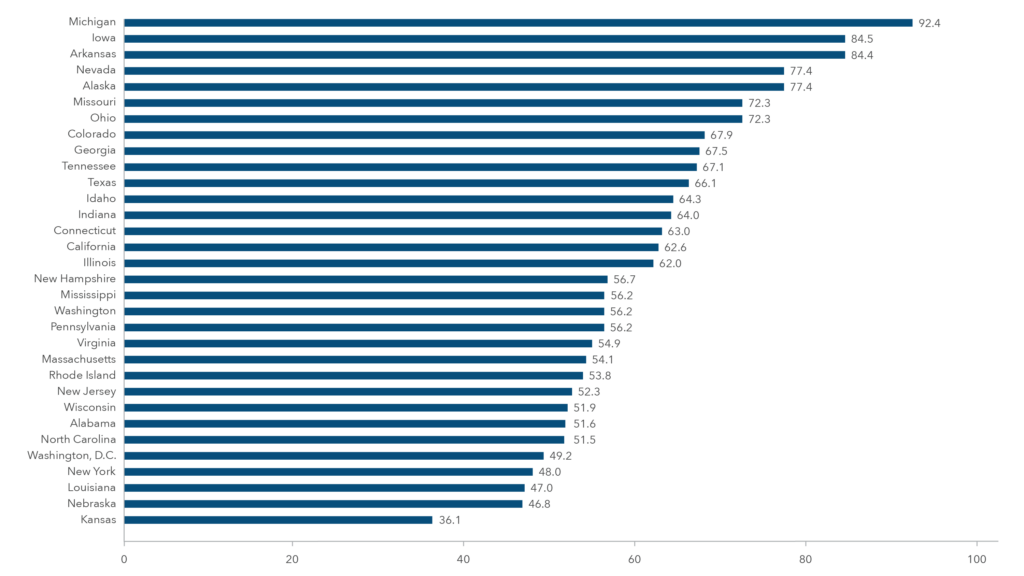

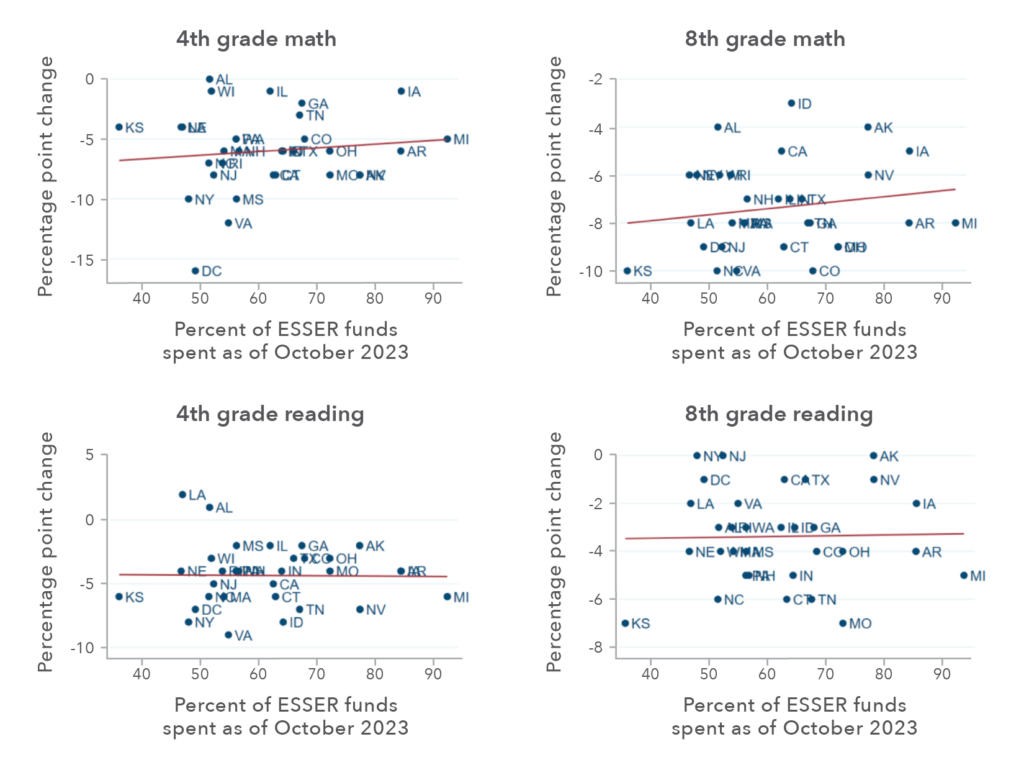

- School districts were slow to start spending this aid but are now on track to spend all funds by next year. The Georgetown University Edunomics Lab’s ESSER Expenditure Dashboard indicates that, despite delays in spending their allocations initially, schools nationally are on track to exhaust their allocations by the September 2024 deadline. In the 2020–2021 school year, states spent funds at a $1.9 billion per month rate, which has accelerated to $5.1 billion per month. A pace of $4.9 billion per month would exhaust funds by September 2024. However, districts vary significantly in the share of funds currently exhausted. Figure 3 displays the share of ESSER allocations spent (as of October 2023) for the 32 states that publish timely spending reports. The shares spent range from a low of 36 percent across Kansas schools to 92 percent across districts in Michigan. An obvious question is whether the spending of these funds has been associated with improvements in student outcomes. We consider this question with a simple correlation; figure 4 plots state-level changes in the share of students at or above NAEP Basic assessment levels from 2019 to 2022 against the share of allocated pandemic relief funds that a state has spent. While there is little relation between spending and student reading levels, states that spent a larger portion of their ESSER funds saw relatively smaller declines in the share of students at or above an NAEP Basic level on fourth- and eighth-grade math tests, a finding consistent with a positive effect of spending on learning-loss mitigation in math. This pattern of results is in line with prior evidence that student achievement in math is more sensitive to school inputs than achievement in reading is, perhaps because students spend more time building reading skills at home.

Figure 3: Percentage of ESSER funds spent, by state: October 2023

Source: Edunomics Lab ESSER Funds Dashboard.

Figure 4: Relationship between state ESSER spending and change in percentage of students scoring at or above NAEP Basic level, 2019–2022

Source: Achievement levels from NAEP; state spending shares from Edunomics ESSER Funds Dashboard.

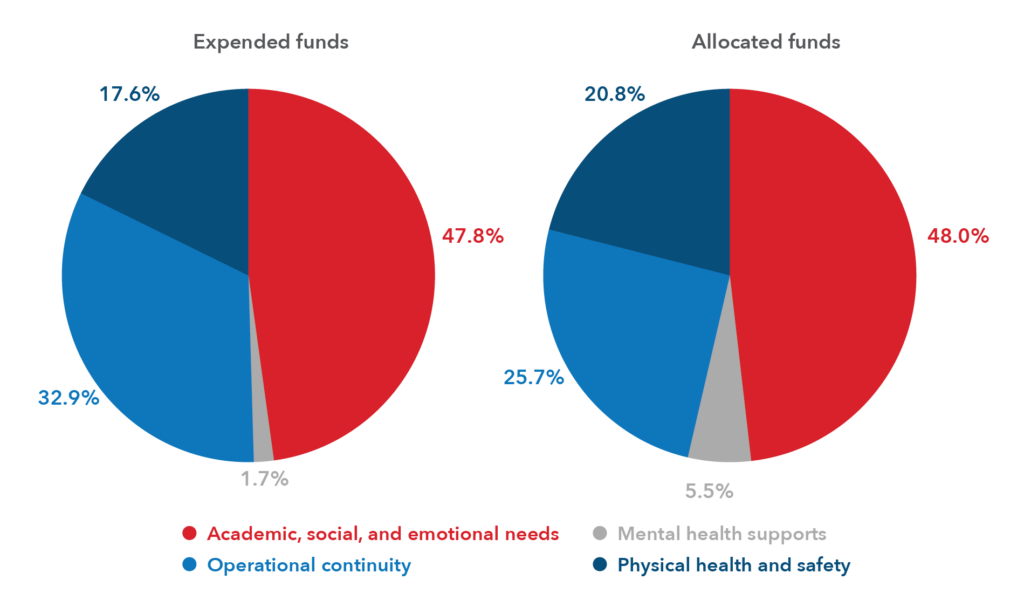

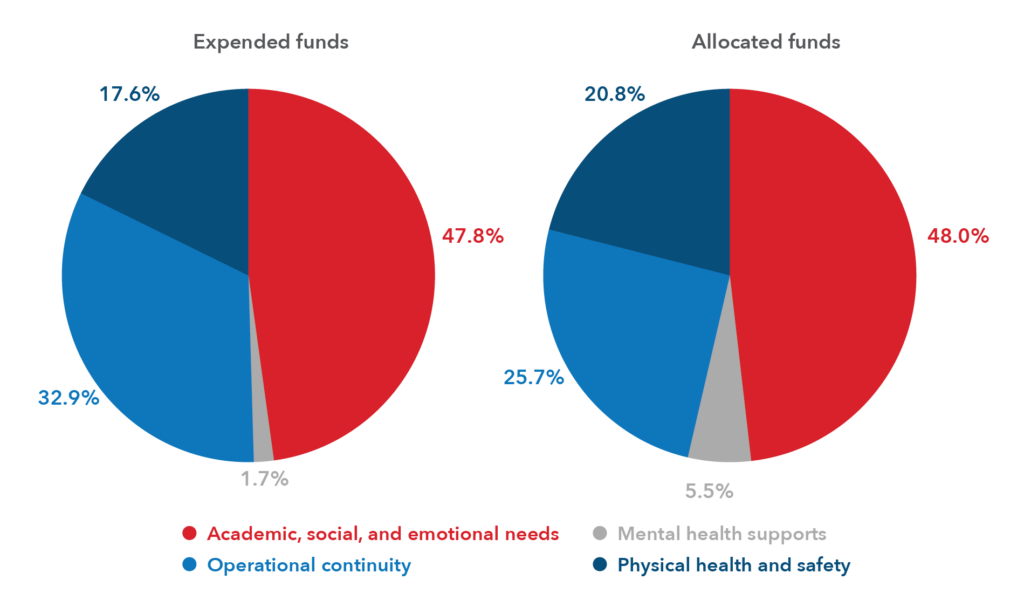

- District spending plans do not indicate an intention to increase the share of remaining ESSER funds spent on student academic needs, despite the size and persistence of learning losses. The latest spending reports to the Department of Education (from FY 2022) indicate that school districts have spent about 48 percent of ESSER funds on “Meeting Students’ Academic, Social, Emotional, and Other Needs” compared to 33 percent on “Operational Continuity,” 18 percent on “Physical Health and Safety,” and just 2 percent on “Students’ Mental Health Supports.” Based on how districts report the portion of remaining funds that they intend to spend on each activity, schools are planning to maintain that same share of spending on academic needs in their remaining set of funds. A 2023 McKinsey and Company survey of school district administrators found that only 30 percent of schools plan to spend significantly on educational supports to remedy learning loss—supports like high-dosage tutoring and intervention curricula–mainly because of the perceived high cost of these interventions at scale and because these interventions require ongoing funding that will not be available after ESSER funds expire in 2024.

Figure 5: Categories of ESSER funds already expended or allocated for use

Source: Department of Education ESSER Transparency Portal.

- Districts need more time, more resources, and more accountability to alleviate pandemic-induced learning loss. Jens Ludwig and Jonathan Guryan make the case in their AESG chapter on pandemic learning loss that the federal government can do three things to effectively help students make up ground lost in academic progress since 2020. First, schools need more time to spend their funds. Districts were slow to start spending their allocations, and placing an arbitrary deadline of September 2024 to spend ESSER funds incentivizes districts to spend funds in ways that meet this deadline rather than in ways that most effectively help students over the long term. Second, schools need more resources. As noted above, ESSER funds represent a small share of K–12 schools’ annual funding, and even the latest ARP funds were appropriated before the magnitude of pandemic learning loss was fully appreciated. The federal government should offer support on a scale that matches the size of the problem students face. Finally, many steps districts need to take to effectively address learning loss may not be easy—such as changing HR models or the structure of school days—and the federal government should provide districts with accountability and other nudges to help schools make these choices that are difficult in the short run but beneficial to students over the long term.

THE BOTTOM LINE

The destruction to educational progress among America’s youngest students will be one of the most profound, long-lasting effects of COVID-19. If it is left unaddressed, as these students today reach adulthood, American families will be less economically secure, and the American economy will be less productive and less globally competitive. Yet, policies today are dictated by deadlines set years ago and funding allocated before the scope of the problem was fully known. Providing schools with more time, more resources, and more accountability to help students get back on track is one of the most important ways policymakers can help create a generation equipped to meet the challenges it will face.

Download (PDF)