In Brief: The Recent Rise in US Labor Productivity

BRIEFLY

US labor productivity has enjoyed a period of renewed growth over the past year, interrupting a nearly twenty-year decline: the 2.7 percent productivity growth in 2023 outpaces the 1.5 percent annual average since 2004, and it nearly matches the 2.9 percent pace seen during the country’s last productivity surge in the 1990s. While the post-pandemic shift to remote and hybrid work as well as technological advances in Generative AI tools tend to dominate the debate about long-term worker-productivity trends, a likelier driver of recent productivity growth is the renewed surge in new-business creation since 2020, reversing decades of declining business dynamism in the United States. Although it is unclear whether the past four quarters of stronger productivity growth signal a longer-term trend, policymakers have an array of options to increase the likelihood that this upswing turns into a period of sustained growth.

WHAT TO KNOW

Rising worker productivity enables the economy to produce more with the same inputs.

Labor productivity measures the output produced per hour of work. Productivity growth is central to economic growth, as it enables workers to “do more with less,” in colloquial language. As workers produce more in a given set of hours, firms are able to raise pay without raising prices, fostering real wage growth and a rising standard of living. Indeed, a 2019 AESG policy paper by Michael Strain documented the tight link between labor productivity growth and real wage growth over many decades.

After decades of slow productivity growth, strong estimates over the past year suggest that period has come to an end.

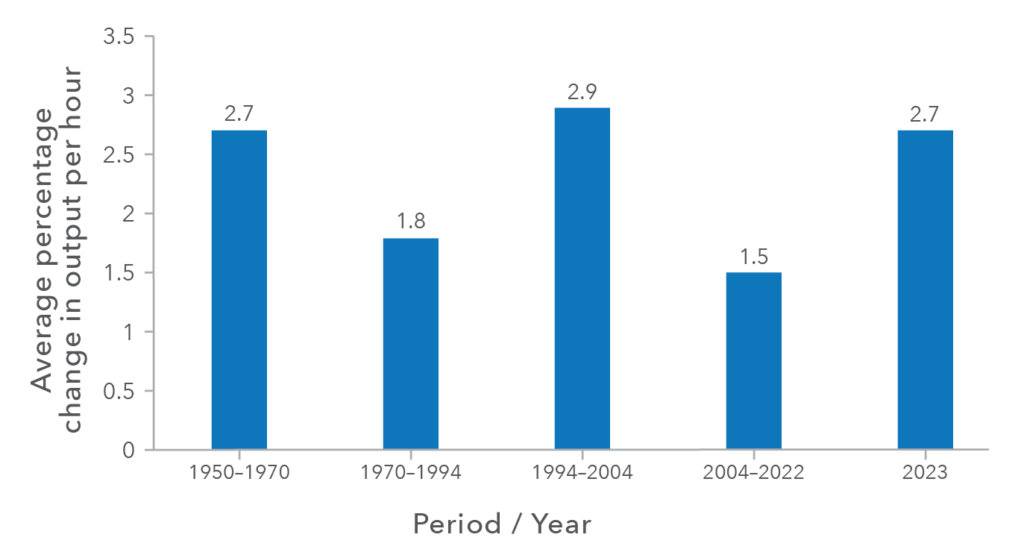

Economist Robert Gordon has documented that the United States enjoyed a “special century” of productivity growth from just around the Civil War until the 1970s. Innovations during that time—including electricity, railroads, and the automobile—dramatically raised the productive capacity of US businesses. During the tail end of that century, from 1950 to 1970, worker productivity was growing at an average annual rate of 2.7 percent. Since then, the economy has experienced three distinct phases of productivity growth: a slowdown in the quarter-century from 1970 to 1994, when growth averaged 1.8 percent; a decade of faster growth from 1994 to 2004, when the internet revolution sped business productivity growth to a 2.9 percent rate; and finally a return to slower growth of 1.5 percent from 2004 to 2022. In the four quarters of 2023, however, productivity growth has experienced a renewed surge, averaging 2.7 percent—equal or similar to those prior waves of productivity growth.

Figure 1: US labor productivity growth, 1950-2023

Source: Author’s calculations based on Bureau of Labor Statistics data.

Note: Productivity growth rates here are averages of quarterly estimates within each period.

The post-pandemic surge in new-business creation is a major factor contributing to rising productivity.

The entry and growth dynamics among young firms—whereby a small portion survive and mature into tomorrow’s large, well-known companies—is a significant driver of job creation, innovation, and productivity growth. These firms create new innovations and generate greater competition, driving less productive firms out of the market. As documented in an AESG paper by Ufuk Akcigit and Sina T. Ates, the US has experienced a broad-based slowdown in business dynamism from 1970 through 2020, which was characterized by a steadily falling share of business entry: the portion of all US firms less than one year old fell from 14 percent in 1978 to 9 percent in 2020. Economists using Census data on the universe of nonfarm business in the U.S. have causally linked this “startup deficit” to a 3.1 percent drag on aggregate productivity since 1980.

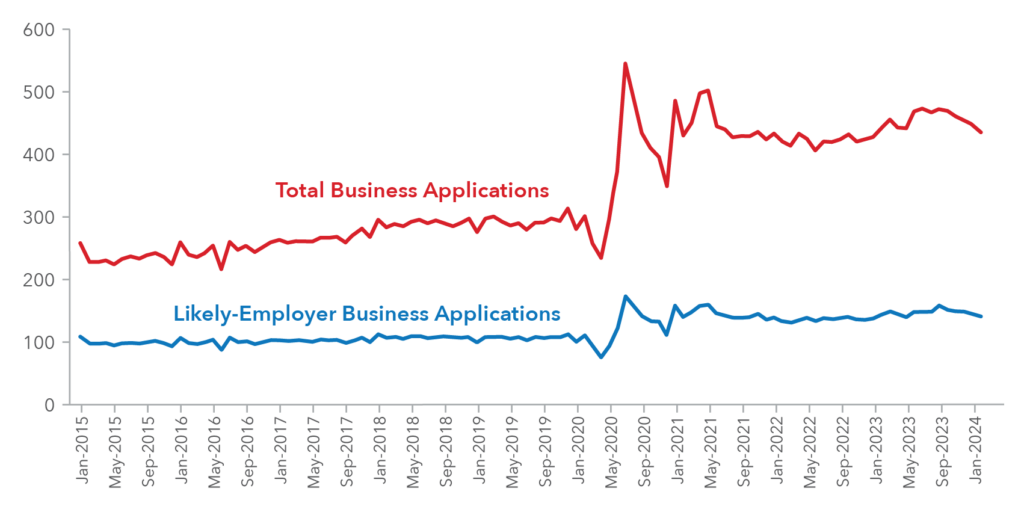

Since 2020, however, there has been a reversal in this trend of declining business dynamism. According to the Census Bureau’s Business Formation Statistics, 5.4 million new-business applications were filed in 2023, greater than the 3.4 million in 2019 and more than in any year since the Census began tracking this data in 2004. New business applications through the first quarter of 2024 have outpaced 2019 levels by 54%. Economists have found that this growth in new business applications is strongly associated with the entry of new business establishments and with job growth – indicating that the US economy is beginning to see the real effects of this surge. Recent analysis also noted that high tech sectors such as information and business services, which disproportionately contribute to aggregate productivity growth, have seen particularly elevated levels of new business application and establishment entry. These signs, along with the historically causal relationship noted above, point to entrepreneurship as a key driver of productivity growth.

Figure 2: Monthly number of business applications, in thousands, seasonally adjusted, January 2015–January 2024

Source: Author’s calculations using the Census Bureau Business Formation Statistics.

Note: “Likely-Employer” business applications are those identified as having a high likelihood of employing workers within four quarters of application.

Generative artificial intelligence (GenAI) is likely not a driver of this recent upswing in productivity growth.

Over the long term, GenAI could raise productivity both by helping workers to do their jobs better today and by, eventually, enabling the discovery of new innovations. However, recent innovations have likely not been a driver of observed increases in worker productivity to date. The introduction of GenAI tools such as ChatGPT and Copilot is exciting, but it will take time for their potential to be effectively incorporated into work processes at scale. For instance, positive effects of GenAI in specific industries have been documented recently: one study of over 5,000 customer support agents found that the use of an AI-based assistant raised agent productivity (issues resolved per hour) by 14 percent on average and by 34 percent for new and low-skilled workers. But widespread adoption of such tools across the economy remains low: the Census Bureau’s Business Trends and Outlook Survey found that just 4 percent of firms are using AI currently. Furthermore, as AESG member Erik Brynjolfsson has noted, such technologies also require investments of both resources and time to take effect—meaning that these advances might be a temporary drag on productivity before reaping significant benefits over the long term.

The effect of remote work on employee productivity remains uncertain.

The rise of remote and hybrid work arrangements has been one of the most significant shifts in the post-pandemic labor market. In the US, the share of paid days spent working from home has settled at about 28 percent in 2023, up from 7 percent in 2019. While some have cited this shift as a possible driver, and while employees often perceive themselves as more productive when working from home—largely because the average American saves 55 minutes per day in commuting time alone—the rise of remote work is not likely to have driven the recent increase in measured productivity (output per paid hour of work). In fact, a recent study of call center workers at a Fortune 500 company found that the shift to remote work during COVID-19 caused a productivity decline of 4 percent. Furthermore, economists studying engineers at a large technology firm found that remote work resulted in less feedback for the most junior engineers, which could ultimately reduce their skill development and long-term productivity. To be sure, however, the net effect of remote work on productivity will take time to play out, as workers learn better ways to collaborate in this new environment and as supervisors adopt better management practices for remote workers.

Policymakers have evidence-based options to accelerate productivity growth by supporting America’s renewed business dynamism.

As Ben Jones argues in his recent AESG paper, policymakers should take a portfolio approach to investing in innovation, making small bets on a wide range of opportunities—each with great potential but also risk. The federal government can embrace this philosophy to support today’s cohort of new businesses by expanding proven funding models. The Small Business Innovation Research program runs a competitive grant program aimed at helping startups find a path to commercialize their innovations. Research looking at the last three decades of program data has found that businesses that received these small ($150,000) early-stage grants applied for more patents, reported higher revenue, and were twice as likely to receive subsequent private capital investments when compared to similar applicants who did not receive funding. Importantly, these positive effects are not a result of investors seeing these grants as some sort of “government certification”; rather, they arise because this funding gives founders resources to prototype ideas they then bring to market. Historically, new-business creation has driven productivity growth when the small share of high-impact startups begin scaling their ideas—expanding such proven models of support can help to remove the financial frictions that prevent many high-potential startups from making it to the stage where America’s deep capital markets can then step in.

THE BOTTOM LINE

Growth in labor productivity is a key mechanism through which the US economy can grow without consuming more resources and stoking inflation, making the decades-long decline in productivity growth troubling and the recent upswing all the more encouraging. A primary driver of the recent upswing has been the reversal in decades of declining business dynamism, as seen in the surge in new-business creation. While the past four quarters of productivity growth have been welcome, policymakers can take steps to turn this recent upswing into a long-term rise in productivity growth—and with it, workers’ wages and Americans’ living standards.