June 2024 Jobs Report: Entering a New Phase of the Job Market

The BLS estimated that the US economy added 206,000 jobs in June, with the unemployment rate ticking up from 4.0% to 4.1%. Three things stood out beneath the headlines of this report.

1. Revisions to April and May Show a Softer Job Market

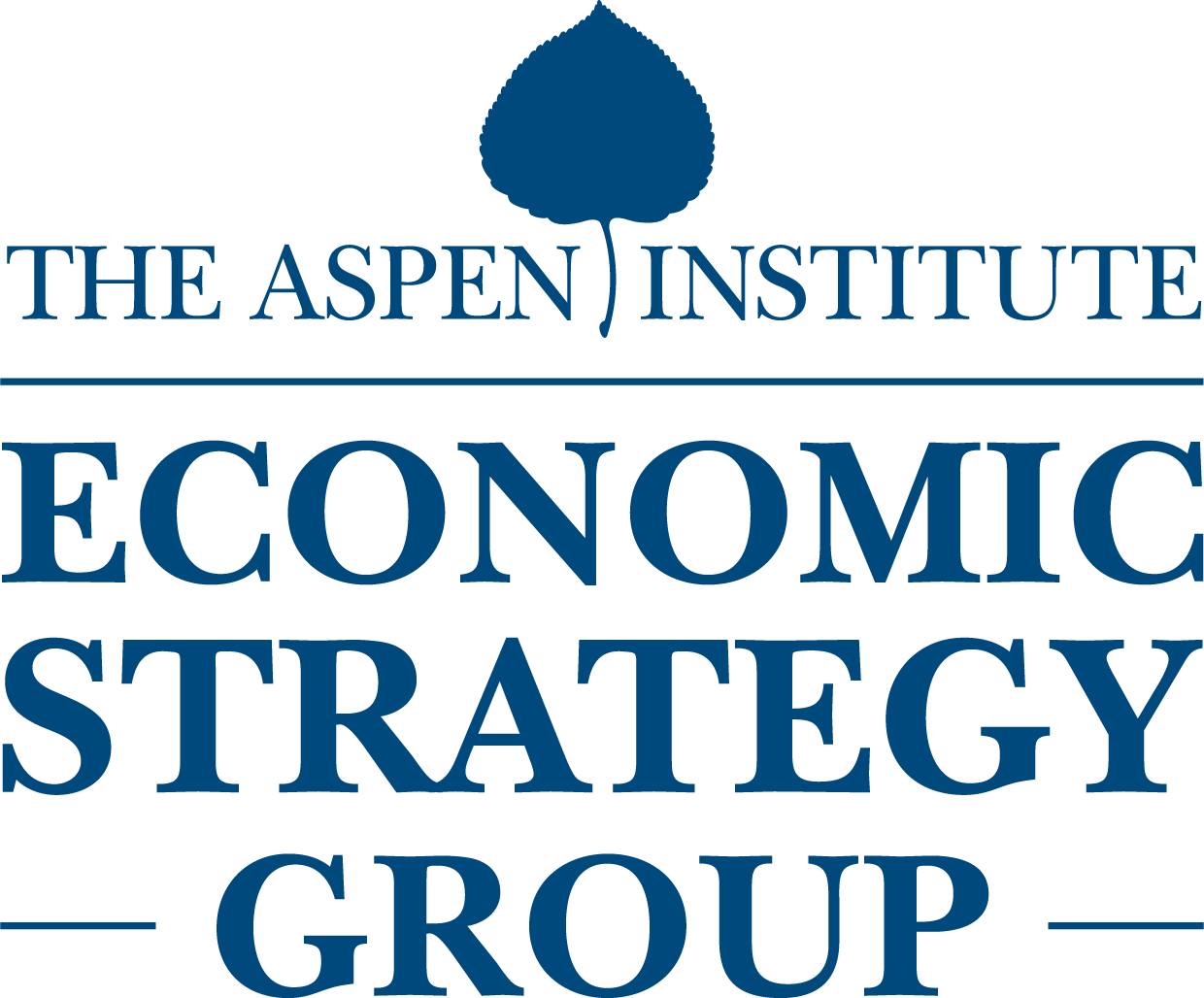

While the topline number of 206,000 jobs added in June was about in line with market expectations, the biggest signal in today’s report were the revisions of job growth in April and May. After today’ report, employment growth over those past two months was revised down by a combined 111,000 jobs. Accounting for June’s data and those prior revisions, the three-month average of job gains now stands at 177,000 jobs, the lowest this measure has reached since January 2021.

2. Unemployment Rate Has Started to Steadily Tick Up

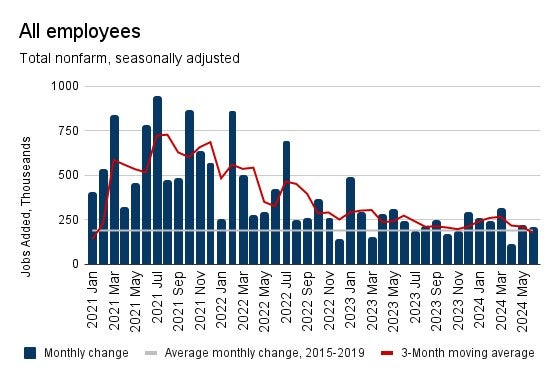

As monthly job gains have slowed, the share of workers looking for work but unable to find it has consistently risen in recent months. The path of the unemployment rate can be characterized in two general period since coming down after the pandemic: for 12 months starting in April 2022, the unemployment rate held steady between 3.4% and 3.6%; for the next year it stayed between 3.7% and 3.9%, over the past two months it has ticked up to 4% and now 4.1%. That’s the highest level since November 2021, another indication that the job market has reached a new, cooler period.

3. Wage Growth Reaches Post-Pandemic Low

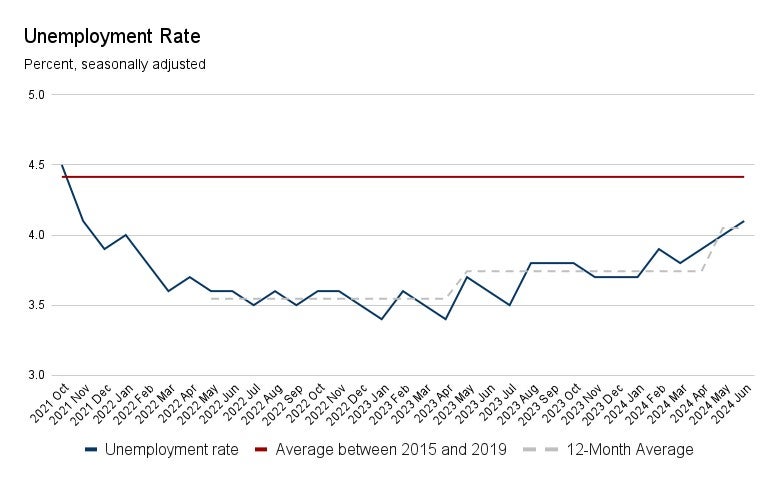

Last month’s data featured strong job gains and an uptick in wage growth. Along with the downward revisions to job growth, the earnings data in today’s report shows a return to the gradual cooldown in wage pressures. Indeed, among all employees, average hourly earnings grew by 3.86% over the past year, the lowest rate of growth in the post-pandemic recovery period.

What this means:

Nearly all major data points in today’s employment report indicate we are entering a new phase of the job market. At the start of this year, the labor market looked surprisingly resilient, but the slower job growth, higher unemployment, and moderate wage gains seen in June all point to a labor market that is now quite close to a healthy “normal.” This softening, taken together with the significant cooldown in inflation over the past two months, should set policy makers up to start bringing down interest rates later this year.