Fiscal Policy With High Debt and Low Interest Rates

SUMMARY:

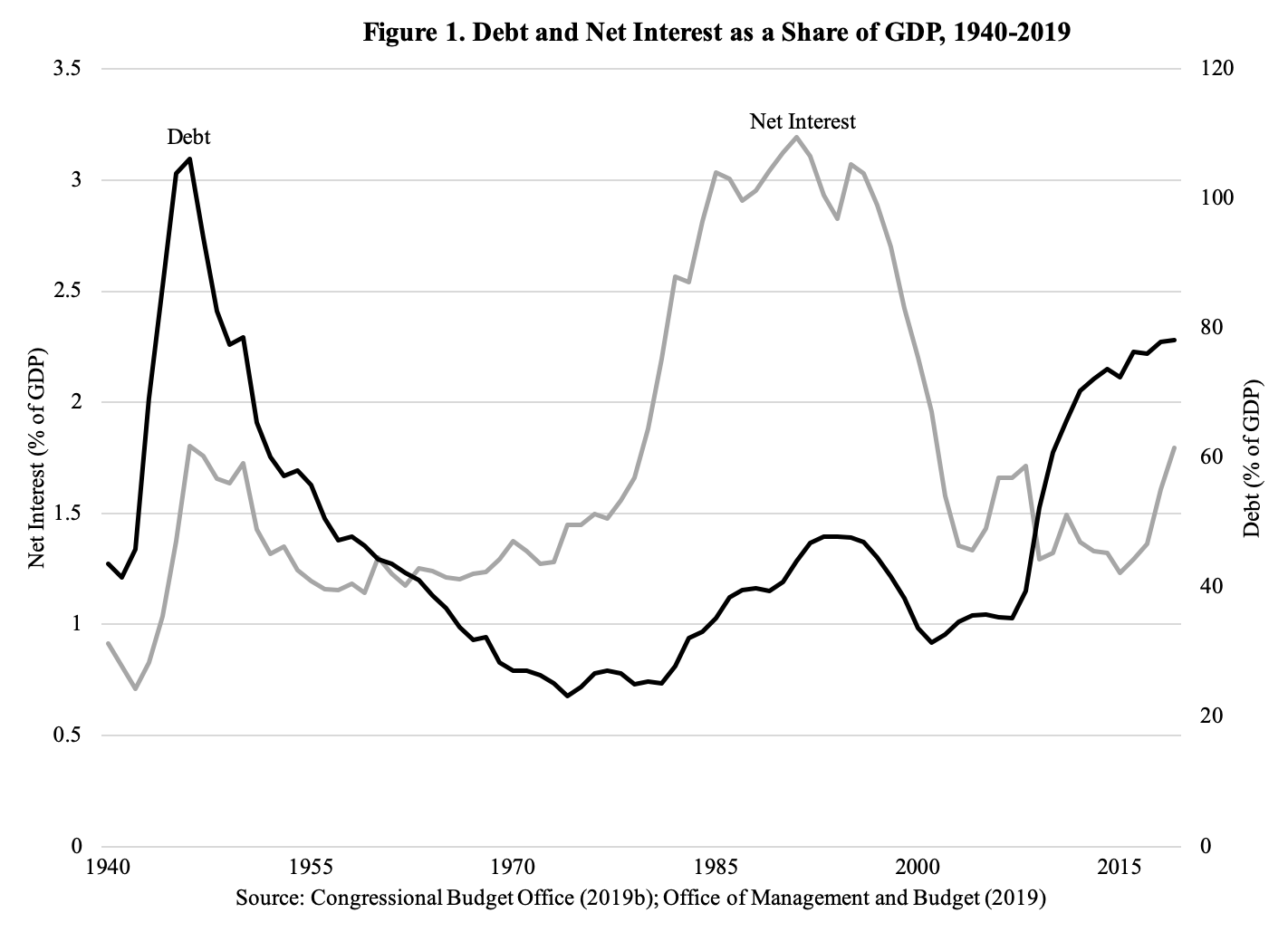

The U.S. budget trajectory is in uncharted territory. The country faces a structural deficit, accrued the largest increase in debt on record during the current economic recovery, and is expected to surpass its WWII-era debt-to-GDP record of 106 percent within the next 30 years.

Gale argues that although historically low interest rates reduce the cost of government borrowing, they are not a “get out of jail free card.” Rising debt will slowly but surely make it harder to grow the economy, boost living standards, respond to wars or recessions, address social needs, and maintain the nation’s role as a global leader.

Gale argues that policymakers should enact a debt reduction plan that is gradually implemented over the medium- and long-term. This would avoid reducing aggregate demand significantly in the short-term and, if done well, could actually stimulate current consumption and production. Doing so would also stimulate growth in the long-term, provide fiscal insurance against higher interest rates or other adverse outcomes, give businesses and individuals clarity about future policy and time to adjust, and provide policymakers with assurance that they could consider new initiatives within a framework of sustainable fiscal policy. In the short-term, policymakers should increase spending on infrastructure, R&D, children, families, and human capital. He also argues that the federal government should implement consumption- and carbon-based taxes to raise more revenue.

KEY FINDINGS:

- The U.S. budget trajectory is in uncharted territory. There has never before been a projected permanent imbalance between spending and taxes.

- If interest rates rise to a more historically consistent level in the next 30 years (while still remaining below the economic growth rate) the national debt will rise from the current 78% to 169% of GDP by 2049, or about 49 percentage points higher than the maximum U.S. debt level reached in World War Two.

- The U.S. faces two intertwined problems: The rising, long-term debt profile and the way we tax and spend. Government spending is too oriented toward consumption relative to investment, the latter broadly defined to include human capital. Moreover, as payments towards health care, social security, and interest liabilities pile up, spending in other areas will fall relative to GDP.

- The economy is more important than the budget. With current low interest rates, low inflation, and concerns about weak growth even amidst remarkably accommodative monetary and fiscal policy, it would be prudent to make any fiscal adjustments gradually.

- Although interest rates are low, the size of the debt will cause interest payments to take up ever-larger shares of the federal budget. Over 100% of new federal spending is expected to go to three areas: social security, health care, and interest payments.

AUTHOR RECOMMENDATIONS:

- Policymakers should not try to reduce the short-term deficit. The long-term projection is the problem. Cutting current deficits would likely reduce aggregate demand, a change that monetary policy may be hard-pressed to offset, given low interest rates.

- In the near-term, policymakers should not enact deficit-financed spending for non-investment programs, though they should embrace a broad definition of what constitutes an investment, to include programs that make people more productive by providing childcare, job training, and related items.

- Policymakers should initiate substantial new investment programs in infrastructure and research and development (1% of GDP) and in children, families, and human capital (another 1% of GDP).

- Enacting a consumption tax (value-added tax) whose rates rose gradually over time would stimulate current consumption as customers spent more today to avoid higher future prices. Likewise, introducing a carbon tax with rates that rise over time could stimulate current production, as producers choose to use more fossil fuels now while they are still relatively inexpensive.

- In the long-term, policymakers must enact a debt-reduction plan that is gradually phased in. This will allow time for businesses, investors, and citizens to adjust their plans and would reduce political backlash.