Concerns About Concentration

SUMMARY:

A number of studies in recent years have fueled policymakers’ concerns over rising market concentration and the state of competition in US industry. However, determining the relationship between market concentration and other key economic outcomes—such as markups, profit rates, labor share, and the state of competition more broadly—is fraught with empirical challenges. The state of evidence is actually much less clear than some popular commentary would suggest.

Rose argues that highly aggregated measures of concentration across industries, which are used in many of the most provocative studies, cannot be used to draw conclusions about concentration dynamics due to a host of methodological challenges. Instead, industry-level studies are necessary to accurately assess causal relationships. These more appropriately modeled studies generally find no direct relationship between changes in concentration measures and changes in market competitiveness or performance. Despite the rise in aggregate concentration measures, Rose argues that all sectors remain well below market structure thresholds in the DOJ and FTC’s enforcement guidelines. Moreover, rising national concentration is not mirrored at more local levels, where measures of concentration have been declining over time. Still, Rose believes there is room for improving competition policy, as many instances of anti-competitive behavior have gone unchecked by the courts and merger enforcement has been weakened over time.

KEY POINTS:

- The concentration of revenues among the largest firms within broad industry categories have increased over the past 20 to 40 years. Average markups (the difference between price and marginal cost) appear to have increased over time.

- However, Rose is cautious about the interpretation of these measured trends given their inconsistency with other macroeconomic data. It is also unclear what higher markups imply about the state of competition, as a rise in markups could be the result of more efficient firms lowering their marginal costs. Higher markups could also reflect increased economic rents.

- Measurement of concentration in the labor market is also fraught with ambiguity. Though most studies report a negative correlation between measures of labor market concentration and workers’ wages, they shed little light on the underlying reasons why wages are inversely related to employer concentration.

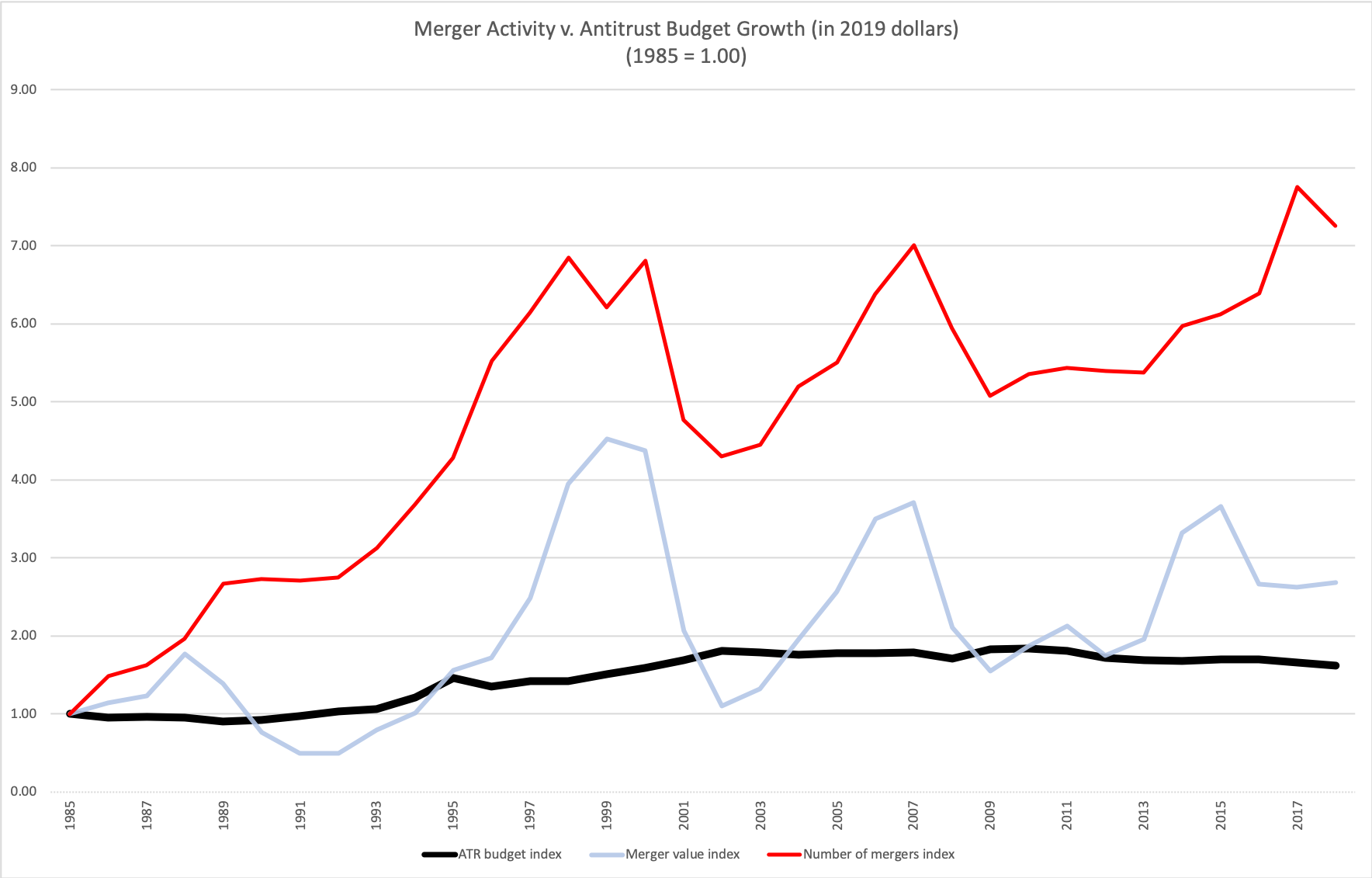

- Antitrust and merger enforcement has become less vigorous in recent decades. The burden of proof has become higher for plaintiffs across a range of anticompetitive behaviors. Courts also show a greater tolerance of behaviors that were once considered potentially illegal, such as predatory pricing, vertical restraints, and most favored nations clauses. Merger enforcement has become weaker, due in part to an increase the market structure thresholds used by enforcement agencies over time.

- Department of Justice Antitrust resources have also become increasingly strained. Rose argues that the lack of available resources has created a regulatory environment in which problematic anticompetitive conduct is rarely enforced against.

AUTHOR RECOMMENDATIONS:

- The U.S. government has likely retreated too far from its role to ensure open, fair, and competitive markets. Rebalancing competition law to invigorate enforcement will require a combination of agency action and legislative intervention.

- Increase the Department of Justice Antitrust Division and the Federal Trade Commission budgets to address the stagnant resources enforcers have had to work with amid an increase in both the number and scale of merger activity.

- Promote a culture of interactions between agency economists and academic researchers to develop new theories and tools for enforcement. Additionally, encourage academic research to educate and validate these new conclusions for enforcers and the courts.

- Embrace new economic models and understandings of competitive dynamics more quickly. Doing so could require taking on cases that incur more litigation risk, but it will likely increase the potential for protecting competition policy.

- The DOJ and FTC should adopt lower concentration thresholds to determine whether a merger challenge should be pursued.

- Consider settling fewer problematic mergers The legal system’s bias towards settlement (as opposed to litigation) often benefits firms, who can leverage asymmetrical information to gain the upper hand in the negotiating process with the DOJ and FTC.

- Update guidelines for vertical mergers. The 1984 Non-Horizontal Merger Guidelines are out of date with current economic understanding of vertical mergers and potential exclusionary behavior, and thus provide little helpful guidance to agency staff or the courts.

- Develop tougher standards against market efficiency defenses. There is little economic evidence to support ex-post efficiency gains from most mergers. Agencies should clarify and toughen the standards how efficiencies are used to defend an otherwise anticompetitive merger.

- Timely progress will require legislation that re-establishes Congressional intent to enforce against a range of anticompetitive behaviors.

- There is ample evidence that regulation as a remedy may be worse than the disease. If regulation is desired as a policy response to unavoidable market power in the digital sector, the most promising direction is likely to be interventions focused on creating interoperability and data portability that facilitate entry and competition.