Can Innovation Policy Restore Inclusive Prosperity in America?

SUMMARY:

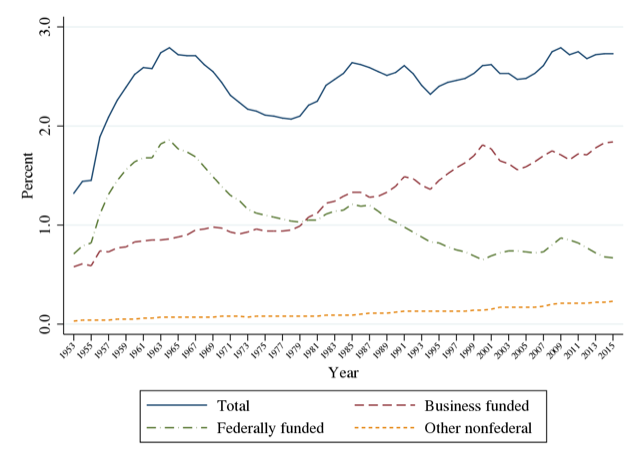

US productivity growth—the engine of long-run wage growth—has been lackluster for the past decade. Meanwhile, US public investment in research and development (R&D), is near historic lows. Although private sector R&D investment has increased over time private sector funding is insufficient to bring about desired gains in productivity growth and wages.

Van Reenen argues the U.S. should pursue a robust innovation policy composed of tax credits, direct subsidies, and human capital investments, which have been shown to spur innovation and wage growth. He proposes combining these approaches into a 10-year $1 trillion Grand Innovation Challenge, which would reinvigorate R&D investment, promote American technological leadership, and advance policy goals of inclusive growth. Van Reenen also recommends against policies that give preferential tax treatment for corporate revenues derived from patents (patent boxes), lower individual income taxes, and support trade protectionism, which are strategies that have thus far failed to promote innovation.

KEY POINTS:

- Across the public sector in the U.S., federal spending on R&D has fallen from 2% to 0.7% of economic output. This is counterproductive in the long-run, since public R&D investment substantially raises productivity growth and wages.

- Heightened productivity growth can actually exacerbate inequality if innovation initiatives and more technological change only increase demand for highly skilled workers. This highlights the need for government to have complementary policies to ensure that the fruits of higher growth are shared equitably.

- There is a strong case for public investment in basic research and development. R&D initiatives often generate significantly more social, macroeconomic, and environmental benefits for the public than just direct financial benefits to the investor. A high percentage of government R&D often goes to universities, research grants, and basic R&D, which has been proven to have a positive casual effect on innovation outcomes.

- The preferential treatment of corporate revenues derived from patents, or patent boxes, often fails to impact the quantity or location of R&D spending and innovation. Another strategy – lowering individual tax rates – is likely to be ineffective in materially increasing the number of U.S. inventors. There is also no clear correlation to heightened innovation and trade protectionism; if anything, reducing global competition reduces the incentive to innovate.

AUTHOR RECOMMENDATIONS:

Van Reenen argues that there are three broad classes of policies — tax incentives, direct government grants, and investments in skilled human capital — where large-scale investment would generate significant productivity and growth benefits. As evidenced by initiatives like DARPA, which helped successfully develop the internet, bundling these types of programs into a broader, mission-driven industrial policy could prove to be especially potent innovation strategy. The following policy recommendations generate a mix of short-term and long-run benefits.

- Tax Incentives: R&D tax credits, which can reduce the cost of investment, can boost overall spending. It’s estimated that a 10% fall in the cost of R&D leads to at least a 10% increase in R&D spending in the long run. This suggests that taxpayers get a big bang for their buck on R&D. Patenting, productivity, and jobs all also seem to increase following tax changes.

- Direct Government Grants: Public R&D spending, when administered properly, can also encourage influence private firms to allocate more funds to R&D than they otherwise would. The National Institutes of Health, military R&D spending, and the Small Business Innovation Research program are all strong examples of initiatives where public funds have crowded in additional corporate investment.

- Investments In Skilled Human Capital: By increasing the supply of quantity and quality of inventors, which in turn reduces the “cost” of R&D workers, can increase the directly or indirectly increase the volume of innovation. There are a wide range of policy tools that could be employed to increase human capital. This includes everything from more investments in STEM education, increases in skilled immigration, and reducing barriers to academic success in disadvantaged communities.