April 2024 Jobs Report: Steady-As-She-Goes Labor Market

The BLS estimated that the US economy added 175,000 jobs in February, with the unemployment rate ticking up from 3.7% to 3.9%. Three things stood out from this report.

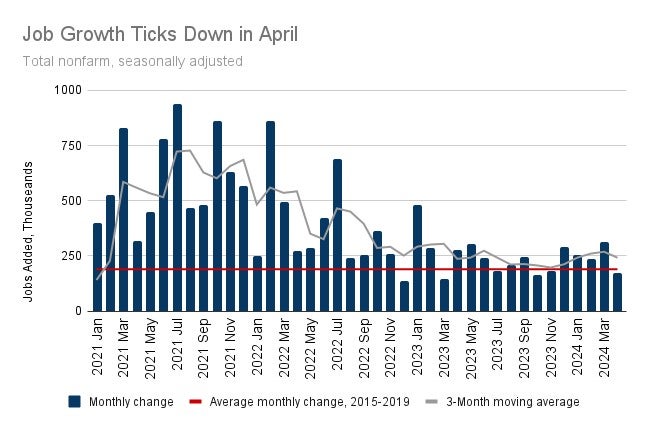

1. Job Growth Ticks Down After Recent Strength

After a string of stronger-than-expected employment gains, job growth cooled down this month. The 175,000 jobs added fell below expectations of 240,000 and the average employment growth over the prior three-month fell from 269,000 to 242,000. Combined with the small negative revisions to the prior two months’ job numbers, these numbers should dispel any ideas that the labor market is re-accelerating.

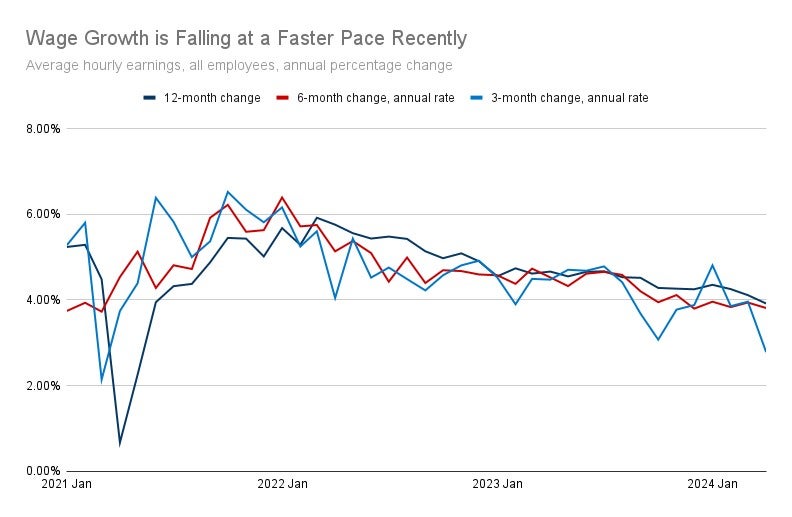

2. Wage Growth Taps on the Brakes

Average hourly earnings for all workers grew by 3.9% over the past year, down from 4.1% last month and far from its post-pandemic peak of 5.9%. Wage growth has been on a slow but steady glide path down since it peaked in 2022, but the slowdown has been sharper in recent months: pay gains over the past three months have come in at an annual rate of 2.8%, the smallest growth rate at any point since the pandemic. These cooling wage dynamics should make policymakers more comfortable that wage growth will not stoke further inflation in the near term.

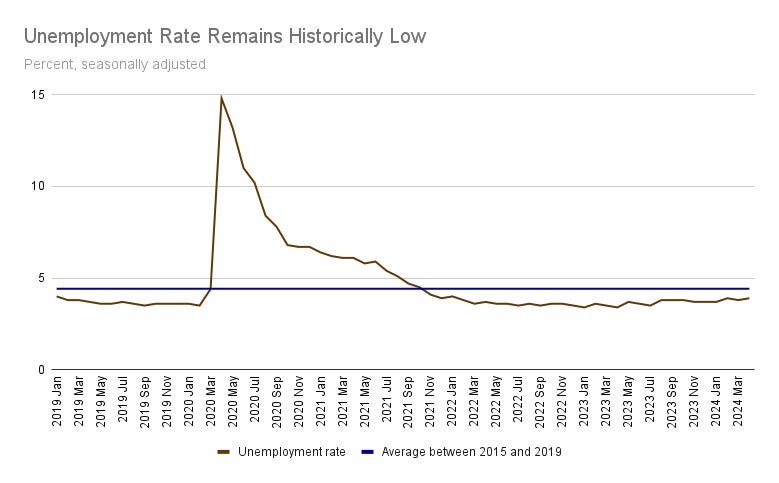

3. Unemployment Rate Remains Within a Narrow Range

The unemployment rate rose to 3.9% in April, returning back to its February level after falling to 3.8% in March. This rate has remained within a narrow (and historically low) range of 3.7-3.9% since August. While these recent numbers are a shift up from the post-pandemic low of 3.4% seen a year ago, April’s number marks the 27th month the unemployment rate has remained below 4% – a sign that workers who have lost their jobs or people just entering the labor force are still having a relatively easy time finding employment.

What this means:

The recent string of strong jobs growth, in combination with other strong economic data reports, brought new questions about whether the economy was heating up just as the Fed had reached the last mile in its efforts to tamp down inflation. This month’s report should make it clear that labor market dynamics are not standing in the way of a soft landing. If these trends continue to play out in the job market, all eyes will be on the next several inflation prints to dictate when the Fed will begin to lower interest rates.