Building a More Resilient US Economy

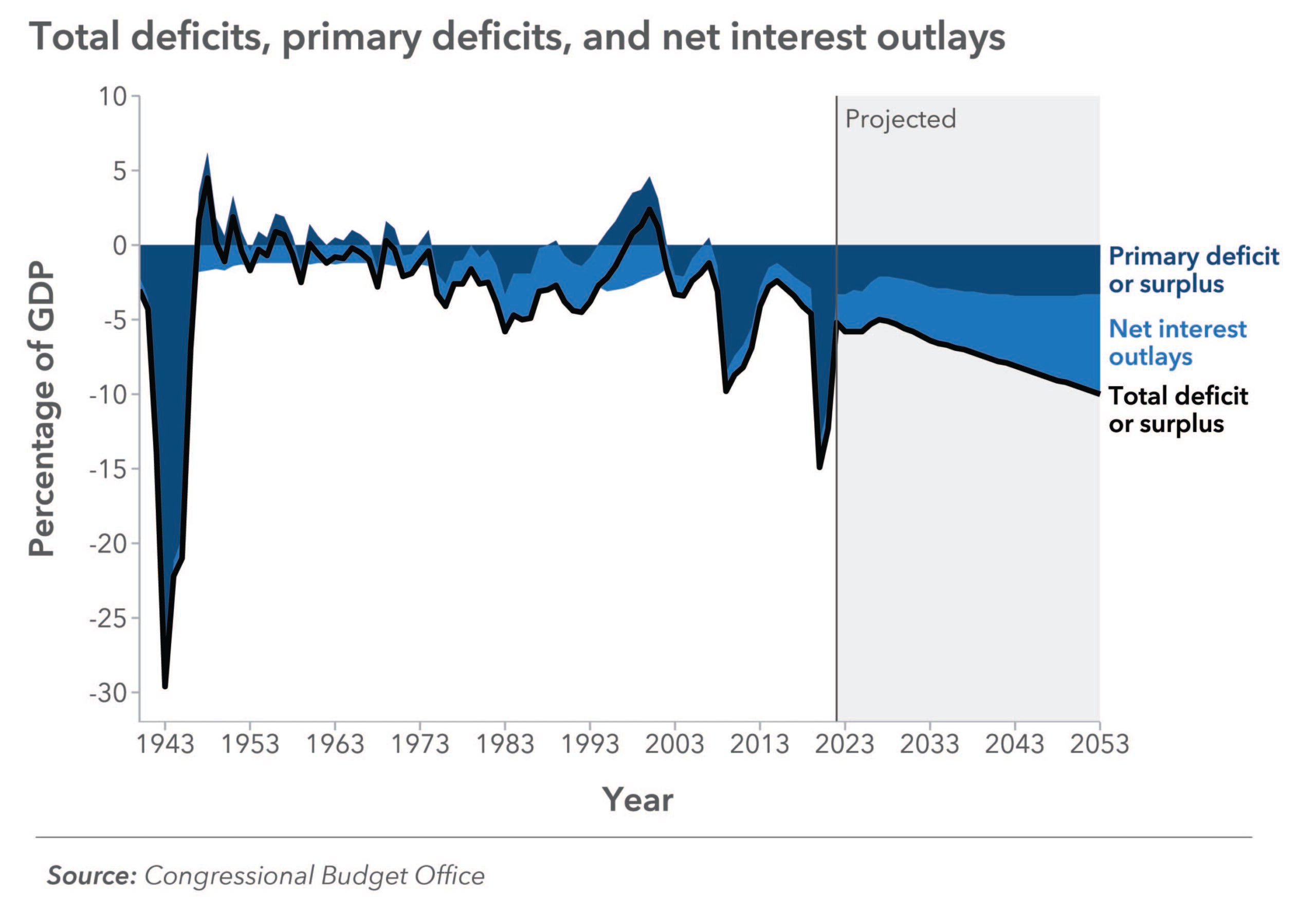

Washington, DC, November 8, 2023 – The Aspen Economic Strategy Group (AESG) today released its sixth annual policy volume, Building a More Resilient US Economy. The book’s publication comes as the US faces historically high levels of debt that threaten the resiliency of the nation’s economy, including the ability to invest in key priorities and adapt to changing global economic conditions. Last month, the Congressional Budget Office (CBO) estimated a $1.7 trillion gap between government spending and revenues in 2023, nearly double the annual budget deficit from last year. The volume’s eight papers offer policy solutions to the federal budget situation (namely, the debt and deficits, tax policy, Social Security and prescription drug prices), investing in children and mitigating pandemic-induced learning loss, and navigating global economic shifts (supply chain resilience and China’s economic outlook).

“Though the US economy has proven to be remarkably resilient in recent years, the nation’s fiscal trajectory is bleak, leaving little space to address our long-term challenges,” said AESG director Melissa S. Kearney. “This year’s AESG policy volume presents evidence-based, bipartisan policy solutions to improve our fiscal situation, develop our workforce, and build a stronger, more resilient US economy.”

“How the United States navigates ongoing economic challenges in the coming years will have significant consequences for decades to come,” write AESG co-chairs and former Secretaries of the Treasury Henry M. Paulson Jr. and Timothy F. Geithner in the book’s foreword. “Policymakers will need to make difficult spending and tax policy decisions to bring the US fiscal situation into better balance and to maintain our ability to invest in key priorities like national security, health care, and addressing climate change.”

The book outlines various evidence-based solutions to some of America’s biggest economic questions: Given demographic and fiscal trends, to what extent will Medicare, Social Security, and other key safety net programs need to be reformed? How should the government raise more revenue to address the federal government’s fiscal imbalance? What are priority investments that we should make to ensure the future workforce to grow the US economy? How can we navigate shifts in the global economy?

The policy volume can be read in full here: Building a More Resilient US Economy

The papers fall under three major themes:

ADDRESSING US FISCAL CHALLENGES

Karen Dynan’s paper, High and Rising US Debt: Causes and Implications, explains why the outlook for federal debt represents a major economic challenge for the US, particularly because, even under optimistic economic scenarios, debt will soon reach levels well above historical experience.

The Social Security trust fund is set to run out by 2033, which would likely force sudden and dramatic across-the-board cuts to benefits. Mark Duggan offers a proposal to reform Social Security and put the program on a more stable financial footing in his paper, Reforming Social Security for the Long Haul.

US policymakers have proposed several solutions to curb rising drug prices, and included provision to allow Medicare to negotiate certain drug prices in the Inflation Reduction Act. Craig Garthwaite and Amanda Starc’s paper, Why Drug Pricing is Complicated, describes the opaque and complex process of pharmaceutical price setting in the US and proposes reforms to make these markets more competitive and efficient.

Owen Zidar and Eric Zwick draw on lessons from the Tax Cuts and Jobs Act (TCJA) to suggest potential reforms to the US business tax regime, with a particular focus on reforming the business tax code, in their paper, The Next Business Tax Regime: What Comes After the TCJA?

INVESTING IN AMERICA’S YOUTH

National test scores revealed major learning loss among elementary school students due to the COVID-19 pandemic. Jens Ludwig and Jonathan Guryan’s paper, Overcoming Pandemic-Induced Learning Loss, discusses the pressing need to address this learning loss using American Rescue Plan funds that expire next year, and proposes high-impact tutoring as a concrete solution to address learning loss and equalize educational opportunities in the long term.

Melissa S. Kearney and Luke Pardue’s paper, The Economic Case for Smart Investments in America’s Youth, observes that the US spends relatively little on children and argues that investing in youth is one of the US’ greatest opportunities to build a more resilient economic future.

NAVIGATING SHIFTS IN THE GLOBAL ECONOMY

Mary Lovely’s paper, Manufacturing Resilience: The US Drive to Reorder Global Supply Chains, evaluates the US’ efforts to strengthen its supply chains through “reshoring,” “friendshoring,” and “derisking” and offers policy solutions to improve efforts to reduce supply risks.

Hanming Fang examines China’s future economic prospects and evaluates the main factors driving uncertainty around China’s economic future in his paper, Where is China’s Economy Headed?

###

The Aspen Economic Strategy Group (AESG), a program of the Aspen Institute, is composed of a diverse, bipartisan group of distinguished leaders and thinkers with the goal of promoting evidence-based solutions to significant U.S. economic challenges. Co-chaired by Henry M. Paulson, Jr. and Timothy Geithner, the AESG fosters the exchange of economic policy ideas and seeks to clarify the lines of debate on emerging economic issues while promoting bipartisan relationship-building among current and future generations of policy leaders in Washington. More information can be found at https://economicstrategygroup.org/.

The Aspen Institute is a global nonprofit organization whose purpose is to ignite human potential to build understanding and create new possibilities for a better world. Founded in 1949, the Institute drives change through dialogue, leadership, and action to help solve society’s greatest challenges. It is headquartered in Washington, DC and has a campus in Aspen, Colorado, as well as an international network of partners. For more information, visit www.aspeninstitute.org.

Washington, DC, November 8, 2023 – The Aspen Economic Strategy Group (AESG) today released its sixth annual policy volume, Building a More Resilient US Economy. The book’s publication comes as the US faces historically high levels of debt that threaten the resiliency of the nation’s economy, including the ability to invest in key priorities and adapt to changing global economic conditions. Last month, the Congressional Budget Office (CBO) estimated a $1.7 trillion gap between government spending and revenues in 2023, nearly double the annual budget deficit from last year. The volume’s eight papers offer policy solutions to the federal budget situation (namely, the debt and deficits, tax policy, Social Security and prescription drug prices), investing in children and mitigating pandemic-induced learning loss, and navigating global economic shifts (supply chain resilience and China’s economic outlook).

“Though the US economy has proven to be remarkably resilient in recent years, the nation’s fiscal trajectory is bleak, leaving little space to address our long-term challenges,” said AESG director Melissa S. Kearney. “This year’s AESG policy volume presents evidence-based, bipartisan policy solutions to improve our fiscal situation, develop our workforce, and build a stronger, more resilient US economy.”

“How the United States navigates ongoing economic challenges in the coming years will have significant consequences for decades to come,” write AESG co-chairs and former Secretaries of the Treasury Henry M. Paulson Jr. and Timothy F. Geithner in the book’s foreword. “Policymakers will need to make difficult spending and tax policy decisions to bring the US fiscal situation into better balance and to maintain our ability to invest in key priorities like national security, health care, and addressing climate change.”

The book outlines various evidence-based solutions to some of America’s biggest economic questions: Given demographic and fiscal trends, to what extent will Medicare, Social Security, and other key safety net programs need to be reformed? How should the government raise more revenue to address the federal government’s fiscal imbalance? What are priority investments that we should make to ensure the future workforce to grow the US economy? How can we navigate shifts in the global economy?

The policy volume can be read in full here: Building a More Resilient US Economy

The papers fall under three major themes:

ADDRESSING US FISCAL CHALLENGES

Karen Dynan’s paper, High and Rising US Debt: Causes and Implications, explains why the outlook for federal debt represents a major economic challenge for the US, particularly because, even under optimistic economic scenarios, debt will soon reach levels well above historical experience.

The Social Security trust fund is set to run out by 2033, which would likely force sudden and dramatic across-the-board cuts to benefits. Mark Duggan offers a proposal to reform Social Security and put the program on a more stable financial footing in his paper, Reforming Social Security for the Long Haul.

US policymakers have proposed several solutions to curb rising drug prices, and included provision to allow Medicare to negotiate certain drug prices in the Inflation Reduction Act. Craig Garthwaite and Amanda Starc’s paper, Why Drug Pricing is Complicated, describes the opaque and complex process of pharmaceutical price setting in the US and proposes reforms to make these markets more competitive and efficient.

Owen Zidar and Eric Zwick draw on lessons from the Tax Cuts and Jobs Act (TCJA) to suggest potential reforms to the US business tax regime, with a particular focus on reforming the business tax code, in their paper, The Next Business Tax Regime: What Comes After the TCJA?

INVESTING IN AMERICA’S YOUTH

National test scores revealed major learning loss among elementary school students due to the COVID-19 pandemic. Jens Ludwig and Jonathan Guryan’s paper, Overcoming Pandemic-Induced Learning Loss, discusses the pressing need to address this learning loss using American Rescue Plan funds that expire next year, and proposes high-impact tutoring as a concrete solution to address learning loss and equalize educational opportunities in the long term.

Melissa S. Kearney and Luke Pardue’s paper, The Economic Case for Smart Investments in America’s Youth, observes that the US spends relatively little on children and argues that investing in youth is one of the US’ greatest opportunities to build a more resilient economic future.

NAVIGATING SHIFTS IN THE GLOBAL ECONOMY

Mary Lovely’s paper, Manufacturing Resilience: The US Drive to Reorder Global Supply Chains, evaluates the US’ efforts to strengthen its supply chains through “reshoring,” “friendshoring,” and “derisking” and offers policy solutions to improve efforts to reduce supply risks.

Hanming Fang examines China’s future economic prospects and evaluates the main factors driving uncertainty around China’s economic future in his paper, Where is China’s Economy Headed?

###

The Aspen Economic Strategy Group (AESG), a program of the Aspen Institute, is composed of a diverse, bipartisan group of distinguished leaders and thinkers with the goal of promoting evidence-based solutions to significant U.S. economic challenges. Co-chaired by Henry M. Paulson, Jr. and Timothy Geithner, the AESG fosters the exchange of economic policy ideas and seeks to clarify the lines of debate on emerging economic issues while promoting bipartisan relationship-building among current and future generations of policy leaders in Washington. More information can be found at https://economicstrategygroup.org/.

The Aspen Institute is a global nonprofit organization whose purpose is to ignite human potential to build understanding and create new possibilities for a better world. Founded in 1949, the Institute drives change through dialogue, leadership, and action to help solve society’s greatest challenges. It is headquartered in Washington, DC and has a campus in Aspen, Colorado, as well as an international network of partners. For more information, visit www.aspeninstitute.org.