Improving Housing Affordability

Housing affordability in the United States has become a major challenge for Americans and a key policy priority for US policymakers. In this paper, Benjamin Keys and Vincent Reina assess the drivers of the housing affordability challenge, concluding that inadequate supply, barriers to homeownership such as tight credit standards, and the lack of a meaningful housing safety net have made affordable housing increasingly out of reach for many Americans. The authors then propose specific policy solutions to expand supply, improve access to homeownership, and strengthen the housing safety net.

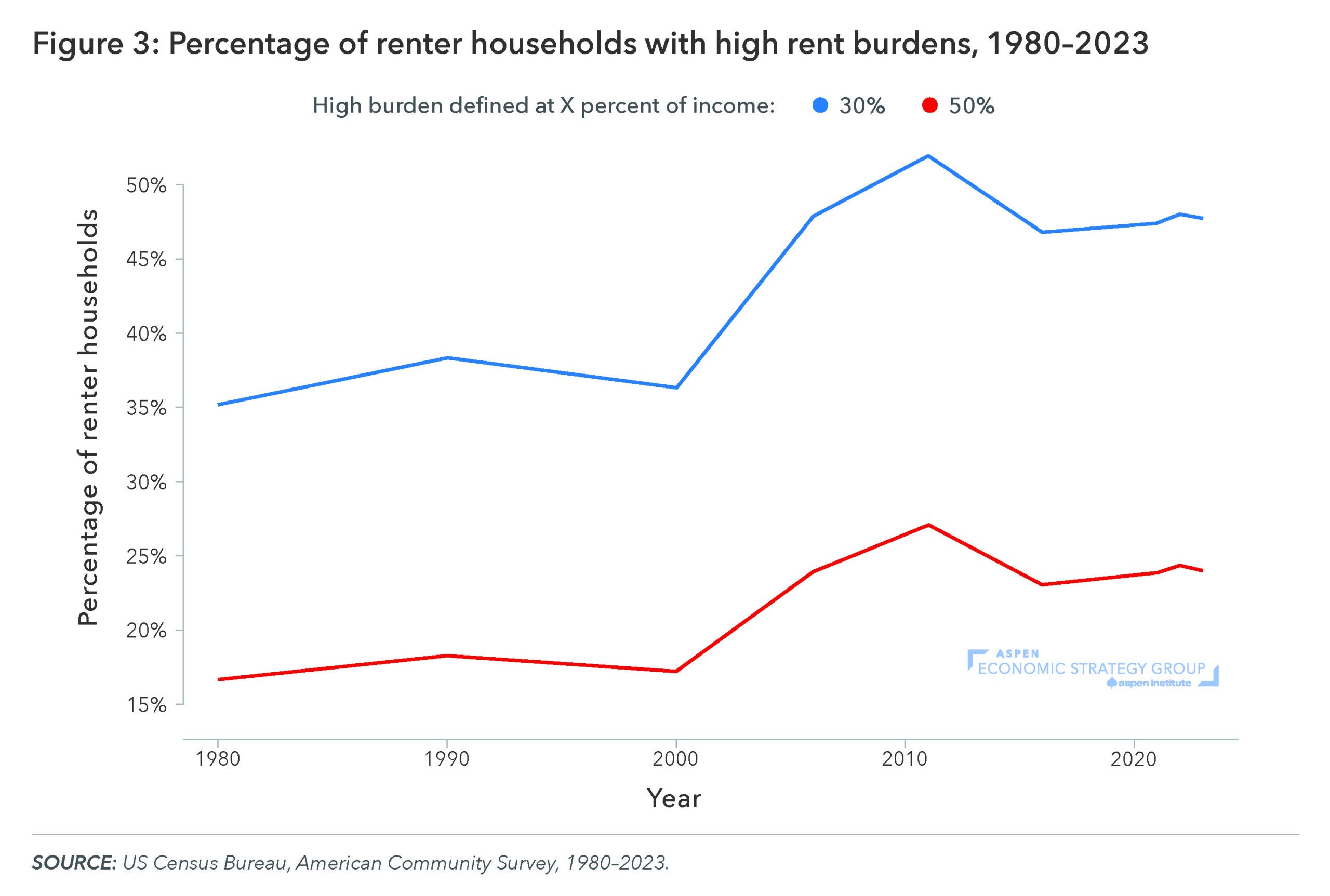

Keys and Reina first lay out several facts about the decline in housing affordability in the United States. Since 1980, median inflation-adjusted rent has nearly doubled—from under $950 to $1,700 in 2023—while the share of affordable rental units has collapsed from more than half of the housing stock to just over 20 percent. The share of renters who are “rent burdened,” spending over 30 percent of their income on housing, has risen from 35 to 48 percent.

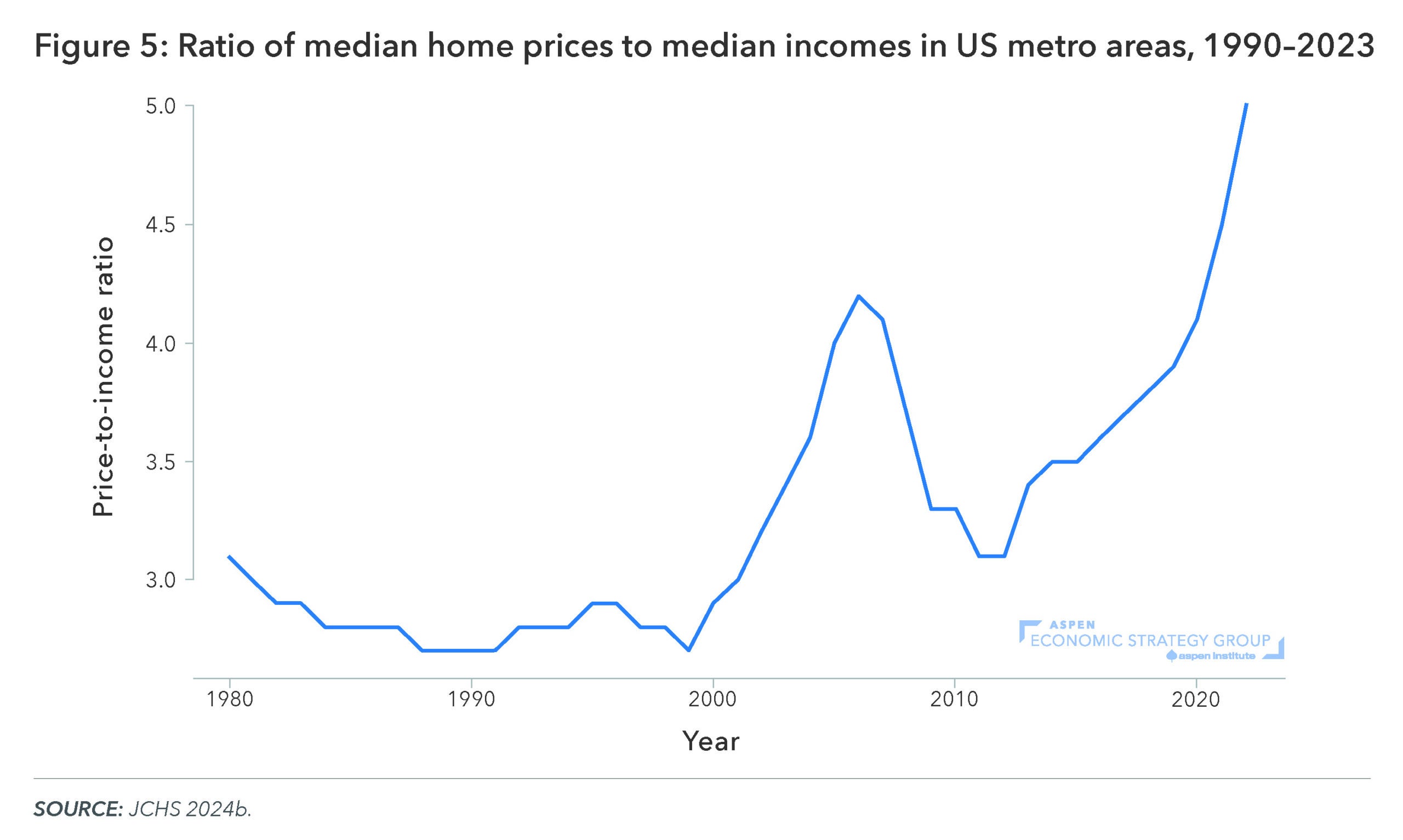

Second, homeownership has become increasingly out of reach. The ratio of median sales price to median income has increased from 2.4 in 1990 to 5 in 2023. With home prices elevated, first-time buyers are entering the market later and in smaller numbers. The median age of a first-time buyer has climbed from 29 in 1980 to 38 in 2024, and the share of all housing purchases made by first-time buyers fell from 50 percent in 2010 to 24 percent in 2024.

Keys and Reina identify four main drivers of the nation’s housing affordability crisis:

Challenges in building housing. Local land-use and zoning restrictions have sharply limited housing supply. Lengthy permitting processes, uncertainty, and high fixed development costs further push up costs for builders, incentivizing the construction of high-priced, luxury units and leaving the low-cost segment undersupplied.

Barriers to homeownership. Homeownership has become increasingly difficult due to tighter credit standards, high levels of student-loan debt, and disproportionately high denial rates for minority households. Lending standards to obtain high-LTV, fixed-rate, 30-year mortgages have increased since the global financial crisis: average FICO scores for newly originated purchase mortgages have increased from 705 in 2006 to 740 in 2022.

A lack of a housing entitlement program. The United States has never had a housing safety net for renters or owners, and the existing assistance leaves many eligible recipients without support. For every one household that receives a housing choice voucher, as many as four other households are eligible. Public housing represents less than 2 percent of units, and the Low Income Housing Tax Credit produces only about 110,000 units annually, often at rents too high for the lowest-income families.

Barriers to financing construction and repairs. Developers and owners both face barriers when trying to finance new development, which affects the supply of new units being built, and rehabilitation, affecting the ability of units to stay in the housing stock. Since 2015, tighter credit standards have constrained developers, landlords of small properties, and homeowners seeking to rehabilitate aging housing stock.

In response to these challenges, Keys and Reina outline three key policy proposals to improve housing affordability:

Make it easier to build. Policymakers at all levels can make it easier to build by accelerating production, reducing barriers, and incentivizing sensible density through zoning reforms, such as reducing minimum lot sizes and parking requirements, and allowing accessory dwelling units near transit. The federal government could further expand multifamily financing through a loan system similar to the current system in place for single-family lending.

Address barriers to home ownership. The tax code can be reformed to reduce barriers to homeownership by converting the regressive mortgage interest deduction into a targeted first-time homebuyer credit while balancing demand-side incentives to avoid driving up prices. Policymakers could also explore taxes on imputed rent to encourage downsizing, make existing mortgages more assumable or portable, and expand tax-credit programs like the proposed Neighborhood Homes Tax Credit to support the development of affordable for-sale housing.

Create a stronger housing safety net. Strengthening the housing safety net would ensure affordable shelter during income shocks by expanding proven tools like direct rental assistance and national emergency-rental support to promote greater housing stability.