July 2024 CPI Report: Trending Towards Two

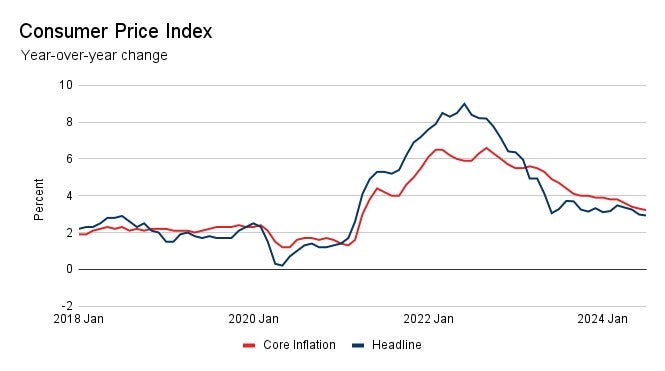

The steady cooldown in inflation that has marked much of 2024 continued in July. The Consumer Price Index rose at a 2.9% annual pace for all items, and at a 3.2% pace for all items excluding food and energy. These headline and core inflation rates are now at their lowest points since March 2021 and April 2021, respectively. Last month, the FOMC statement noted that members are looking for “greater confidence” that inflation is moving sustainably toward its 2% target before lowering interest rates, and the data in today’s CPI report should continue to build that confidence.

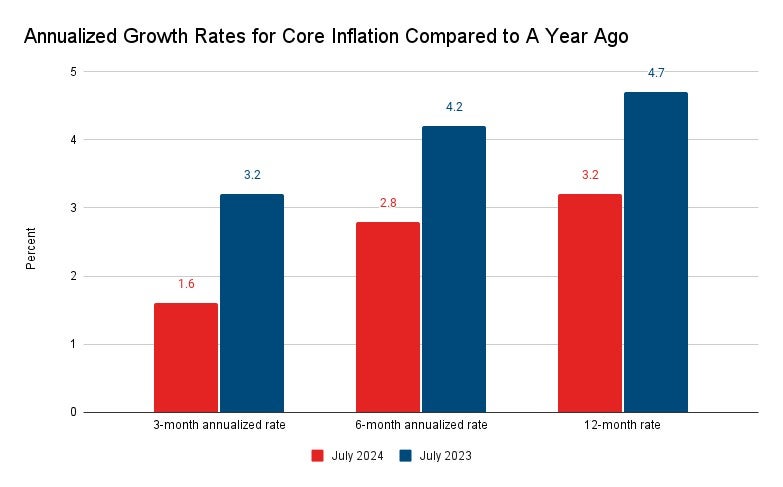

First, more encouraging than the top-line numbers for July are the indications of where inflation is headed. Although core inflation has risen by 3.2% over the past year – still above the Fed’s target – trends in the data over the past three and six months indicate that inflation will continue to fall: over the past six months, core inflation is trending at a 2.8% annual rate, and if we look at just the past three months, it has fallen to a 1.6% pace, below the Fed’s target.

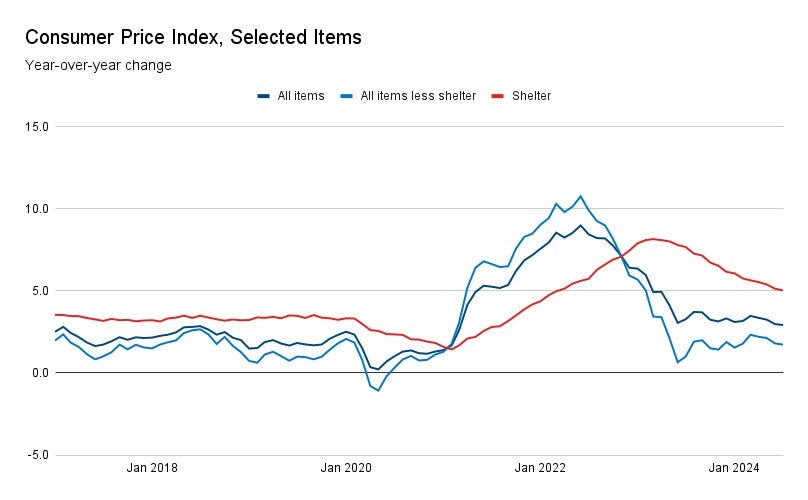

Second, rising housing costs are the largest contributor to price growth right now, and that too is slowly trending down. Shelter prices accounted for 90% of the overall price growth in July, and removing that category, headline inflation was just 1.7% over the past year. The positive news is that shelter inflation in the CPI has been continually falling since reaching a peak of 8% last year: price growth for shelter fell to 5.0% in July, the lowest level since March 2022, and has been trending at a 1.9% annual rate over the past three months.

Today’s inflation readings, along with recent employment data, paint the picture of an economy that has steadily cooled down throughout 2024. The pressures that contributed to high inflation over the past few years – including a tight labor market – have eased. Smaller job gains and rising unemployment have contributed to the slowdown in price growth, and those dynamics make it more likely that inflation will continue to fall sustainably towards 2%.